The Gathering Round-Up

A UK perspective on the US real-estate market in Spring 2024

By Kurt Lyall, General Manager, LoftyWorks

No time to read this now? Download a copy of the pdf here:

The Gathering by Housewire June 24.

Introduction

The US realtor and broker industry comes together every year for an event called ‘The Gathering’ which is hosted by Housewire. This year the event was held in Scottsdale, Arizona. I was able to attend, as I was already in Phoenix, visiting Lofty’s HQ office.

The Gathering is for realtors, brokers, agents and mortgage providers with a sprinkling of proptech vendors too. The presentations were of a high calibre, delivered by founders and CEOs from the largest names in the industry, including CoStar, eXp, Keller Williams, ReMax, Side, Realtor.com, Homes.com and many others.

While on my flight back to the UK, I thought it would be good to reflect on what I had heard and learned during the event from a UK estate agent market perspective and how some of the themes presented might apply to the UK.

A caveat to begin with: the UK property market works differently to the US market. As Glenn Sanford, chair of eXp, put it in his presentation: “the UK is an anomaly versus the rest of the world”.

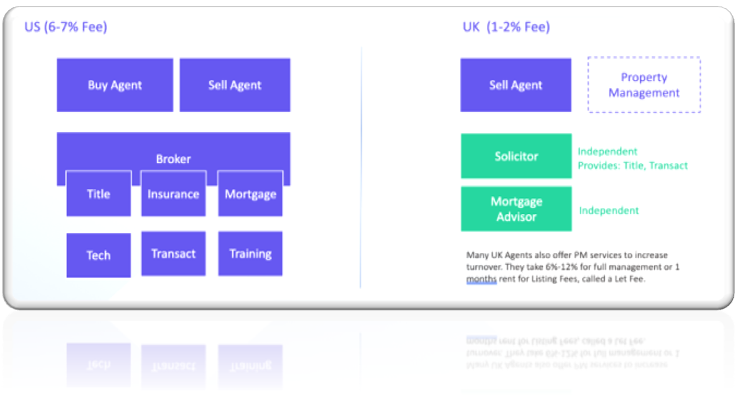

Many other countries follow the same model as the US, where the market operates with both a seller agent and a buyer agent. Behind the scenes, a broker is used to enable the agents and to facilitate the property transaction. A ‘Realtor’ is one business incorporating Buyer Agent, Seller Agent and Broker.

Why is there a chasm in commissions between UK and US?

In the US, 6 per cent to 7 per cent is paid in commissions by the buyer for a house purchase, versus in the UK, only 1-2 per cent is paid.

One key aspect with the UK market is that buyers are unrepresented.

This means that they enter into an agreement to buy a property without a Buyer Agent representing their needs and interests in the process. They take this on themselves.

They do have a lawyer who represents them legally, though, called a ‘Conveyancer’. A conveyancer reviews property title deeds and advises on matters in the sale agreement which requires the buyers’ attention. They do not push the sales process forward, though, or advise on price, budget, location, closing or other matters which traditional US Sales Agents perform.

Realtor.com has been running a successful campaign to highlight the role of the Seller Agent and to align themselves with the agent industry.

A copy of the PDF run in industry press and national newspapers is provided below.

So the buyer being unrepresented is one aspect which lowers UK commission (saving 3 per cent of commission). Other factors include:

- Portals dominate buyer leads – 95 per cent of leads from prospective buyers come from the leading portals Rightmove, Zoopla and OnTheMarket.com. A long tail of 10-20 other portals account for a fraction of the top 3 portals. These portals charge the seller agent a monthly subscription to connect and in return automate much of the buyer finding process. The UK market is largely institutionalised into using these portals to initiate any property search.

- Mortgages are arranged directly – buyers arrange their mortgages by going direct to banks and mortgage providers. If they struggle to obtain a standard mortgage product, the seller agent may refer them to an independent mortgage advisor (they receive a small fee of £500 for the introduction only). Mortgage advisors are regulated in the UK, by the FCA weblink.

- Low barriers to setting up as an agent – it is relatively easy for someone with 2-3 years’ experience, to set up as a seller agent in the UK. This creates a continuous and ready supply of new agents who are willing to undercut prices to win business.

All the above factors have left the UK with around 1-2 per cent commissions on property sales. This low commission has meant the industry has a different personality to that of the US.

I would say this is one of my biggest observations listening and talking to brokers and agents at the Gathering. I honestly believe the US market has a better way of doing business.

Link to PDF

Below is a summary of the business model differences:

One benefit of the UK over the US: Mortgage products sold

Listening to the presentations at the Gathering, it also highlighted a few fundamental differences in the mortgage products sold in the US versus UK.

The UK presently benefits from 2 factors:

- Lower interest rate because of shorter fixed term periods

- Portability of mortgage product to a new property when moving.

In the US, much of the market is locked into a lower interest rate applied to their current property from prior to 2022. This makes switching hard, as the buyer must accept a substantially higher monthly payment for the same equivalent property.

The resultant supply/demand means transaction volume (liquidity) is currently constrained. The feedback from the event was that until US interest rates drop, don’t expect a transformation in sales volumes.

Key differences of mortgage products US versus UK:

| US | UK | |

| Average Term | 15 – 30 years | 2-3 years (typically) |

| Portability | Cannot be moved to a new property (limited with veteran mortgages) | Can be moved to a new property |

| Rate | 15 Year 7.1% APR

30 Year 7.4% APR 5 Year 8% APR

Source: BOA |

5% APR Headline 3 Years Fixed 7% APR equivalent including initial fees. 8% APR after Fixed PeriodSource: Nationwide |

US Market Snapshot

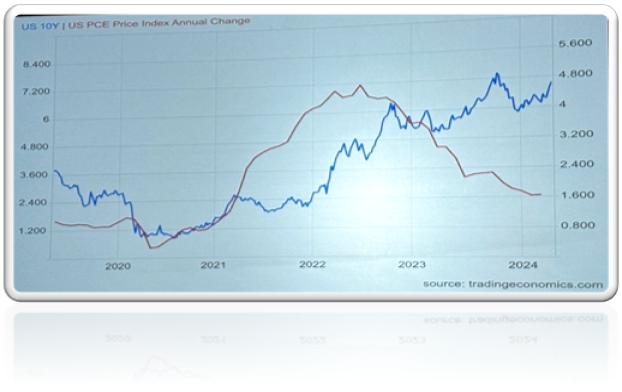

Logan Mohtashami from HouseWire gave a presentation looking at the macro trends impacting the US housing market. He pointed to the high interest rates as a primary driver.

Interest rates are being held high until the labour market softens

The following chart showed 10 Year Bond Yields versus inflation. This clearly shows that inflation has peaked but interest rates are not coming down.

Why is this?

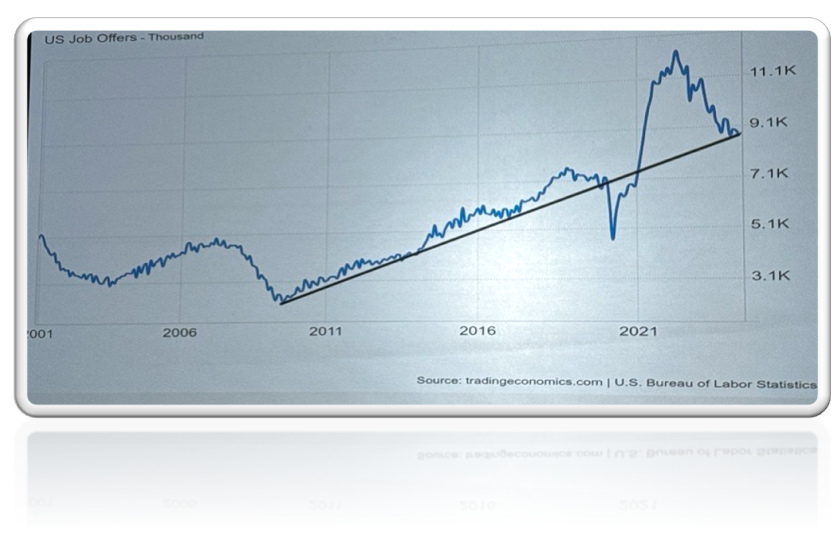

Logan said it was due to the Feds’ focus on creating labour softness. Presently, employers are still experiencing a tight labour market, creating wage inflation.

The chart below emphasises the Fed’s strategy – not only to bring down inflation, but also to soften the labour market. It shows how job offers remain well above pre-2008 levels.

One consequence of these actions, in keeping interest rates high, is a contraction in house moving volume, as shown below.

Inventory volumes remain at historical lows, as potential sellers hunker down and try to “weather it out” until mortgage interest rates drop. This strategy in turn protects property values, as lower volumes keep prices high for buyers and sellers who must move in the current period.

This is also filtering through to new purchase applications for mortgages which are now down to pre-1995 levels.

The context of reduced listing volume of properties in 2023 and 2024 must also be viewed in terms of seasonal changes. The chart above shows the highly cyclical nature of the US market and the lack of volume in 2023.

The context of reduced listing volume of properties in 2023 and 2024 must also be viewed in terms of seasonal changes. The chart above shows the highly cyclical nature of the US market and the lack of volume in 2023.

2024 is shaping up to be only marginally better than 2023.

US market facing headwinds

Mike Simonsen from Altos Research gave a complementary presentation to Logan’s, focusing on some interesting customer segmentations and behavioural changes.

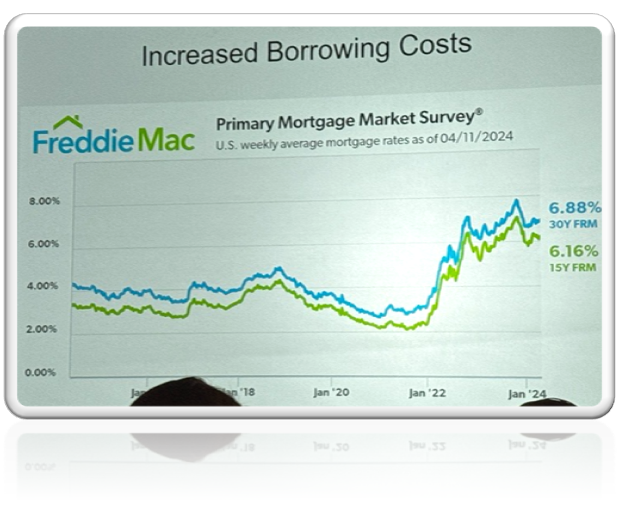

The chart below shows the rapid rise and entrenched interest rates of the US in 2024. This again highlights the impact of interest rates on property affordability now that rates have jumped from 4 per cent to 6 per cent.

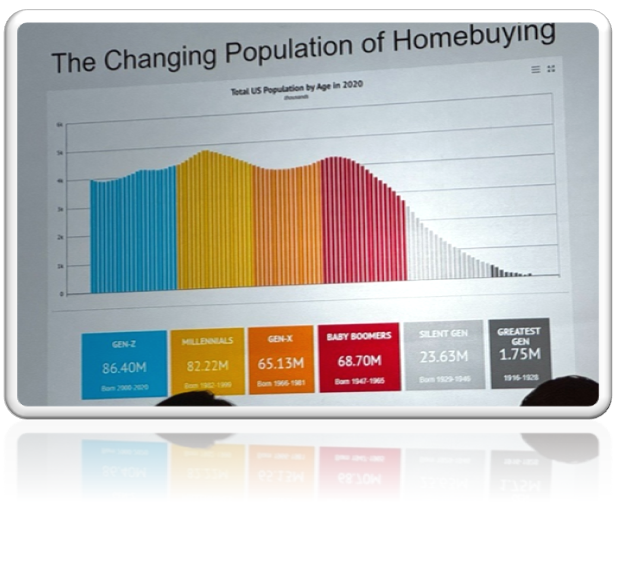

Mike also highlighted some interesting segmentation, showing that Baby Boomers are sitting on the majority of property value in the US. This is to the consternation of Gen Z who are often priced out of the market.

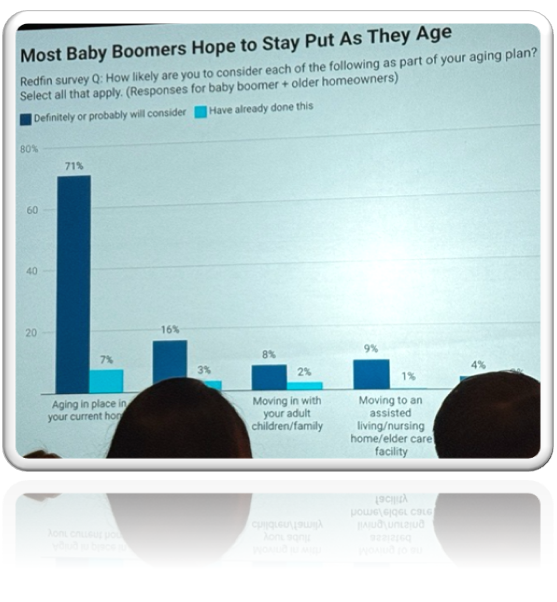

In previous years, the industry had hoped that Baby Boomers would release substantial property value, as they downsize and transfer assets to their children. In fact, the opposite seems to be happening currently. Baby Boomers are content to stay in their properties for as long as possible and do not see the benefits of downsizing – unless forced to by illness.

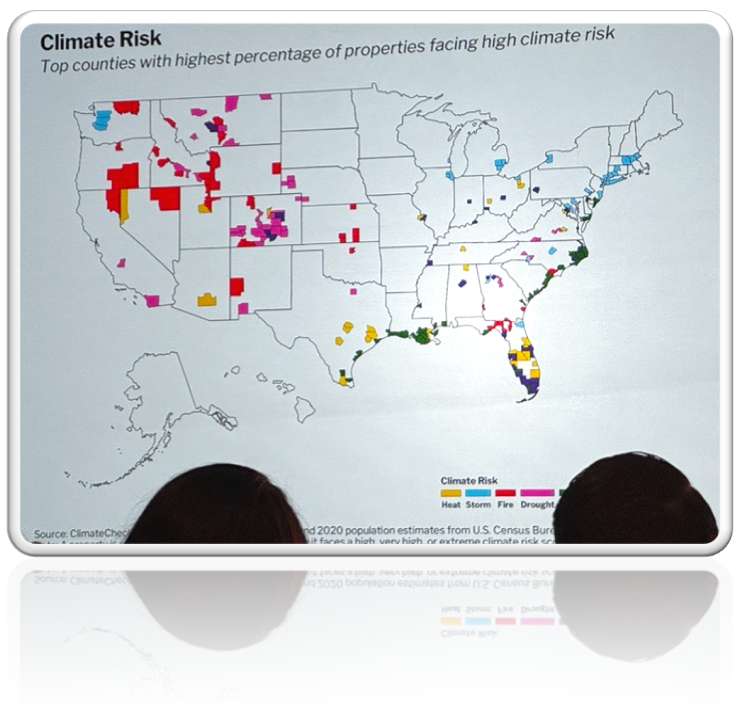

Climate Change

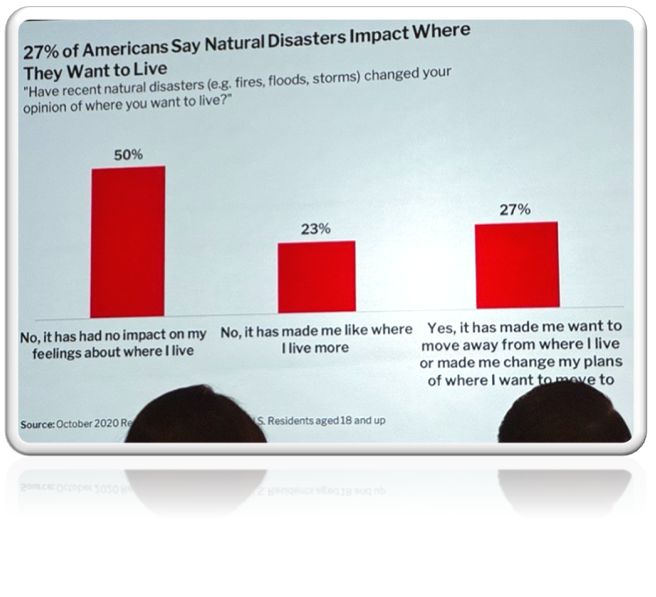

An interesting survey also highlighted that buyers are becoming more sensitive to natural disasters when buying. A shift towards desert cities seems to be preferred to coastal living in places such as Florida.

This is a useful point for UK properties. The UK is an island nation, and most towns and cities are connected to the coast in some way. At present, we are not experiencing the hurricanes that roar through Florida and the Gulf of Mexico, but we are exposed to the slow threat of rising sea levels and more extreme rainfall.

NAR Ruling

The most topical subject at The Gathering event was the impact of the NAR Ruling. This will be implemented by the industry during July 2024 – so not long to see how the industry formally adapts to these changes!

What is the NAR Ruling?

The National Association of Realtors is one of several trade bodies that has previously helped standardise how business real estate gets done. NAR represents the interests of 200,000 realtors and the ‘The NAR ruling’ is one of the largest class action claims against an association. The charges are in the multi-millions of dollars of fines. The NAR fine is $418M, to be paid in staged payments.

The outcome of the ruling is that Buyer agent commission must be agreed separately and can no longer be included automatically and specified through the industry’s MLSs (for the UK audience: a MLS is a Multiple Listing Service, which allows sharing of properties for sale within a group of agents).

To put the ruling into context, 6 per cent commission on a $1m property is $60k. Prior to the ruling, this fee was typically added into the payment schedule for the property and included in the mortgage value that the buyer agrees for the property. Over time, consistent property inflation absorbed this commission and everyone was happy.

Today, those economics have changed with flat property value increases in recent years. It is currently not clear if mortgage providers will absorb the fees on top of the capital price of the property, if there is a high debt to equity ratio on the mortgage.

What is clear, is that brokers and their agents must now sign a separate Buyer Agent agreement with their client. In the past, it seemed that Buyer Agents were relaxed about getting their contracts signed (if they were ever, in fact, signed!). That has changed, a buyer must sign a contract with the Buyer Agent before starting to use their services.

Buyer behaviour will obviously be key to this. Buyers will be able to purchase a property without Buyer Agent representation and are likely to experiment with this over the next 6-12 months. Ultimately, the industry will have to conclude if this is a fad or the new reality.

From a UK perspective: this feels remarkably familiar. As buyers in the UK we do not have a Buyer Agent to help us through the process. Looking at the UK versus US buying experience, I do feel the US experience is better, with a Buy Agent versus without.

Without someone representing the buyer and pushing the transaction forward, time is lost. Buyers have a much more stressful experience and Seller Agents can mess buyers around. So, having a Buyer agent is good for all parties.

A separate question is whether Buy Agents will retain the full 3 per cent commission they have enjoyed in the past. It will inevitably be harder to earn top-level commission rates and service will need to be of a very high standard. It is likely the best agents, as always, will rise to the top.

The US operates at multiple times the scale of the UK

Comparing the US and UK markets side by side, shows that US volumes are around 5-6x larger. This provides greater market opportunities for all players in the US.

| US | UK | |

| Number of Residential Units | 140 million (US Census Bureau 2020) |

29 million (UK Government 2021) |

| Ownership Levels | 66% (US Census Bureau 2021) |

64%

(ONS 2020) |

| Own property outright | 34% (US Census Bureau 2021) |

29%

(ONS 2019) |

| Home sales per year | 5-7 million (NAR 2023) |

1.2 million (HM Land Registry) |

| Agent commission | 6-7% | 1-2% |

Historically, the UK has appealed to many US and overseas investors looking for a safe diversified property strategy. Commonality of language, plus many historical ties, has made the UK property sector particularly attractive as an investment opportunity.

Recently however, Dubai and other central European countries have started to gain momentum, reflecting the shift in global influence away from the UK. The UK still ranks highly for education, but is no longer the financial powerhouse of Europe, it once was.

Summary

The US market is 6 to 7 times that of the UK market and enjoys commissions which are presently 6 per cent versus the UK’s 1 to 2 per cent. Despite being a substantially more lucrative market, some potential issues face the industry in 2024:

- The NAR Commission Ruling – house buyers are now able to buy a property without Buyer Agent-representation. This will add new pressure on agent commissions and some buyers will experiment with new business models. Portals in the US will win, as buyers look for ways to reduce their transaction costs.

- Interest rates are remaining higher for longer – An average mortgage in the US is 7.5 per cent versus UK 5.0 per cent. New buyers want those rates to reduce, in order to come back to the market and buy in volume. Without attractive interest rates, affordability is reduced. Presently there is no sell pressure, and so listing volume (or liquidity) is at a market low.

- Shortage of new housing stock – The US market is short of some 6-7 million units which need to be constructed to cater for demand. New properties are not developed in an environment of high interest rates and it takes several years for property investors to gain comfort to commit to invest. For these reasons, expect shortages to continue to place supply constraints on key markets.

- State level taxes, weather extremes and laws – listening to the talks, state taxes particularly in California are leading to an exodus of workers into Arizona, Texas and other states. Add to the mix weather extremes/natural disasters and this is one of the drivers of net migration within the US.

- Baby Boomers like it where they are – the data suggests that Baby Boomers are hanging onto their properties for longer and not moving, rather than downsizing and releasing equity. This is further constraining market supply and tightening the market supply side.

- Moving friction makes moving harder – homeowners on 4 per cent mortgages are not going to switch to 6 or 7 per cent unless there is a serious and pressing reason to move. Instead most will prefer to adapt their current properties and weather today’s high interest rates. This is constraining market availability of properties. Combined with inflationary wage increases for those lucky enough to be on low fixed interest rates, this means higher disposable cash, which is not being absorbed by moving up the housing ladder.

In summary, it is not plain sailing for the US industry in 2024 and we can expect a turbulent period until interest rates reduce. In the meantime, brokers and realtors need to sharpen their business approaches to winning clients in a tighter market. To operate more efficiently and to defend against competition where sales volume is shrinking.

Kurt Lyall

General Manager

LoftyWorks